Not many people are aware that they’ve got to pay insurance on delivery platforms like Doordash. Most only get to know when they run into a car, or by scrolling through the web.

Then we also have some that believe it isn’t important.

However, having dedicated insurance, isn’t something to joke about, even though DoorDash doesn’t necessarily check for it.

And if you’re looking for the list of insurance you should be going for as a DoorDash driver, this article would provide you with enough resources.

Best Car Insurance for DoorDash drivers

So here is a list of these insurance providers:

State Farm Standard Insurance

Generally, when looking for insurance for DoorDash drivers, you should be looking out for commercial insurance and one from a trusted brand.

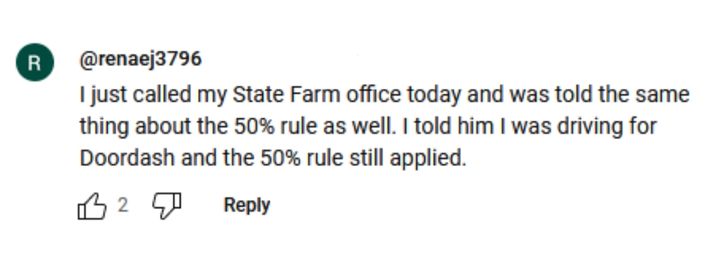

However, state farm breaks the rule by offering a policy that allows customers with the standard auto policy to cover food delivery for people who deliver less than 50% of the time they use their car.

So far, we’ve seen this being applied to both DoorDash and Ubereats.

However, as with most insurance companies and policies, it’s important you do due diligence and better still, call an agent on State Farm. Of course, many factors such as location, age, etc, can play into how this works.

Keep in mind that your vehicle usage for DoorDash shouldn’t be above 50% to avoid being penalized.

Now if this isn’t applicable to you, or you do Doordash for more than 50% of the time, you could always add a rideshare or courier coverage add-on to your normal personal auto insurance with state farm, if you have one.

This would likely not be much of a difference since their price is basically competitive.

USAA

Now as with most people, they already have personal insurance with other companies, hence signing up for another won’t be ideal.

Or perhaps, they dash more than 50% of the time. So it doesn’t cut.

Well, a good alternative is USAA.

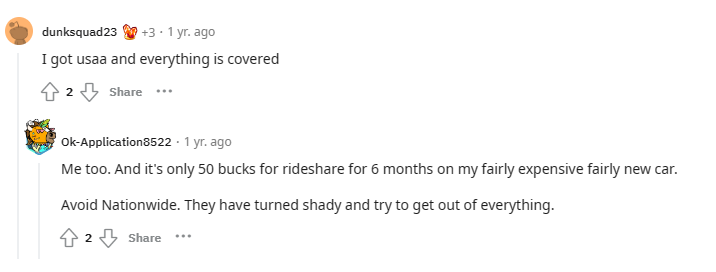

USAA is one of the few insurance companies with a good reputation, pretty much on most platforms, except on Trustpilot. However, personally, it’s always been good reviews from people I’ve seen…

So how do you do it?

First thing, you need a commercial driver or rideshare insurance added to whatever package you have with them. You may also need to speak directly with an agent to know if they’d specifically cover DoorDash in your area.

The problem with USAA, however, is the fact that it’s only applicable to people on active duty or retired military personnel. If you’re also a family member, it should work for you as well.

But if not, you may need to look up to other insurance providers.

Progressive

Progressive is a well-known US-based insurance company with coverage for almost anything you can think of. And yeah, they cover DoorDash and other delivery companies.

However, to use Progressive for DoorDash, you’ll need commercial insurance from the company tailored for food delivery and courier service. Thankfully, the company has this in check.

Talking with an agent will help determine the actual cost.

Editors note: If you stay in the US and California to be specific, there is a list of health insurance benefits available on DoorDash that could be useful.

What Makes a Good Insurance?

1. Credibility

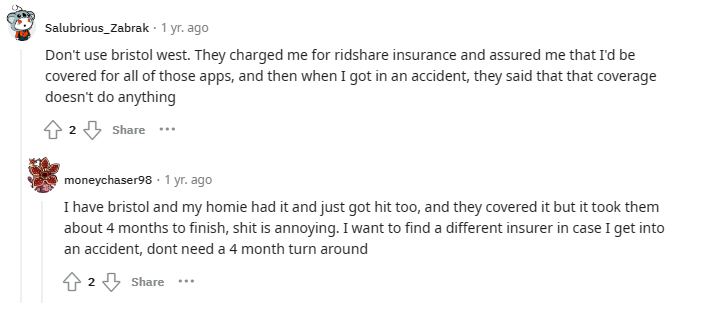

It’s not just about having the best price or covering DoorDash. The question, is how credible are they?

You don’t want to sign up for a company and when the unexpected happens, you start getting stories and your coverage doesn’t apply, eventually. Or in some cases, takes a lot of time.

Generally, when looking for insurance companies, keep an eye on ones with a good history of settling claims fairly and promptly. Check the company’s track record, their customer reviews, and their financial strength.

2. Affordability

A good insurance company should also be relatively cheaper than its available competitors.

Insurance isn’t just a one-time purchase; it’s an ongoing commitment. Therefore, you need to make sure it fits comfortably within your budget.

For some reason, however, you might not be able to tell, as the price of insurance varies from person to person.

However, reviews from people using the same package should give you insight. Also, if possible, contact different companies to see what works best

3. Clarity and Transparency

Insurance policies can often be complex and filled with jargon.

However, a good insurance provider should be able to simplify this information, ensuring that you understand exactly what you’re signing up for.

This is also the reason why you always want to make sure any agent who gives you a quote for your policy understands properly what you ask and need.

You won’t want to be misinterpreted and get into problems when the unexpected happens.

Final Thoughts

Generally, if you already have an insurance package with state farm, making a quick inquiry to see if they offer the less-than-50%-car-use for DoorDash drivers works for you. And if not, giving Progressive and USAA a try is a good move.

As an Amazon Associate, I earn a small commission from qualifying purchases. Learn more about this.